1. Introduction to Printed Circuit Board (PCB)

1.1 What is PCB

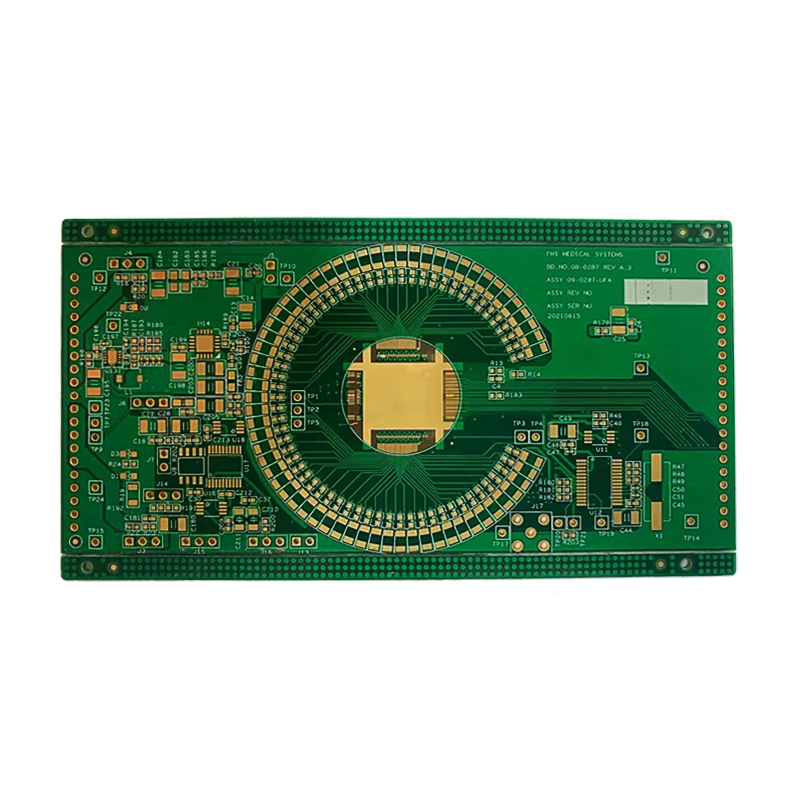

PCB (Printed Circuit Board) is a printed circuit board, which is a support body for electronic components and a carrier for electrical interconnection of electronic components. Because PCBs are made using electronic printing techniques, they are called “printed” circuit boards.

The main function of this product is to make various electronic components form the connection of the predetermined circuit and play the role of relay transmission. Printed circuit boards are the key interconnects for assembling electronic parts. They not only provide electrical connections for electronic components, but also carry business functions such as digital and analog signal transmission, power supply, and RF microwave signal transmission and reception for electronic equipment. Most electronic equipment and products need to be equipped, so it is called “the mother of electronic products”.

1.2 PCB upstream raw materials.

The industrial chain of PCB is clear. The upstream materials include copper foil, resin, glass fiber cloth, wood pulp, ink, copper ball, etc. Among them, copper foil, resin and glass fiber cloth are the three main materials.

1.3 PCB Raw Material Cost Analysis

The cost of PCB is mainly divided into material cost and labor cost. The material cost mainly includes copper clad laminate, copper foil, phosphor bronze ball, ink, etc. Among the cost of PCB, the labor cost accounted for the highest, about 40% of the total cost; among the single materials, the cost of copper clad laminate was the highest, accounting for 30% of the total cost; the cost of copper foil, phosphor bronze ball and ink was lower, respectively Occupy 9%, 6%, 3% of the total cost.

CCL occupies an important position in PCB raw materials, and its cost accounts for 30% of the total cost of PCB. Among the raw materials of CCL, the cost of copper foil is the highest, about 39% of the cost of CCL; the cost of glass fiber cloth and resin is lower, accounting for 18% of the cost respectively. Since the copper clad laminate is greatly affected by the price of copper, the price that indirectly affects the PCB presents a certain periodicity.

1.4 Differences between different PCBs

The thickness of rigid PCB is different from that of flexible PCB, and flexible PCB can be bent. Common thicknesses of rigid PCBs range from 0.2mm, 0.4mm, 0.6mm to 2.0mm. A common thickness of a flexible PCB is 0.2mm. HDI is a high-density interconnected circuit board. The vias of HDI have blind or buried vias. The processing technologies used are micro-blind and buried vias and laser drilling, which have high processing accuracy and low cost. The ordinary circuit board drilling is mainly mechanical drilling, and only through holes make the internal connection of each layer of the circuit.

2. An overview of the PCB industry chain and upstream and downstream enterprises

2.1 Panorama of PCB Industry Chain

As the key electronic interconnection of electronic products, PCB connects many upstream and downstream industries. Upstream industries: copper foil, copper foil substrate, glass fiber cloth, resin and other raw material industries; downstream industries: electronic consumer products, automobiles, communications, aerospace, military and other industries. Midstream substrate: mainly copper clad laminate (CCL), which is processed from raw materials such as copper foil, epoxy resin, and glass fiber yarn. The PCB industry chain is long, and special wood pulp paper, electronic-grade glass fiber cloth, electrolytic copper foil, CCL (copper clad laminate) and PCB (printed short-circuit board) are the upstream and downstream products that are closely connected and interdependent in an industry chain.

2.2 Main raw materials and suppliers upstream of the PCB industry chain

Among the upstream raw materials in the PCB industry chain, copper foil is the main raw material for manufacturing CCL, accounting for about 30% of the total cost. The copper foil production industry has a high degree of concentration, and the industry leader has strong bargaining power. The leading enterprise Nord Co., Ltd. is mainly engaged in the research and development of electrolytic copper foil, and has established stable cooperative relations with large power battery companies such as Ningde Times, BYD, and Yiwei Lithium Energy.

2.3 PCB downstream application scenarios and main customers

The industry concentration of the PCB industry chain decreases in turn from top to bottom. Application requirements in downstream fields can be divided into communication equipment, industrial control medical, aerospace, automotive electronics, computers and other sub-fields. In 2017, the main suppliers of communication equipment PCB products: Huawei, Nokia, ZTE and other leading manufacturers in the global communication industry; in 2017, the packaging substrates for mobile terminals were mainly used in high-end brand mobile phones such as Apple and Samsung. (Report source: Future Think Tank)

3. Downstream application of PCB industry

3.1 Terminal applications and changes of PCB boards around the world

The application field of PCB industry has involved almost all electronic products so far, mainly including communication, aerospace, industrial control medical, consumer electronics, automotive electronics and other industries.

3.2 Terminal Applications and Changes of PCB Boards in Mainland China

In the application field of PCB industry in mainland China, the communication, computer and consumer electronics industries have always been the main fields. Since 2009, the proportion of communication and industrial control medical fields has continued to increase, and the proportion of consumer electronics has continued to decrease.

3.3 The scale of production value of PCB boards

Benefiting from the transfer of global PCB production capacity to the mainland and the influence of the booming downstream manufacturing of electronic terminal products, the PCB market in mainland China has shown a rapid development trend as a whole. From 2014 to 2019, the scale of PCB output value in mainland China generally showed a steady upward trend. Since 2019, Sino-US economic and trade frictions have intensified, economic uncertainty has increased, and the PCB industry has fluctuated in the short term, but the medium and long-term growth trend is still relatively stable. According to Prismark, the overall size of China’s PCB industry market will grow to US$42 billion by 2025.

3.4 CAGR of downstream applications in PCB industry

Affected by the construction of 5G, the field of PCB communication has ushered in a period of rapid growth. 5G construction is accelerating, large-scale volume will be launched in 2020, base station-side PA, filters, and antennas will usher in changes, and the PCB industry will usher in a great opportunity for 5G development. According to Prismark estimates, the CAGR of PCB output value in the global computer field from 2017 to 2021 is estimated to be -3.2%. The main reason is the gradual slowdown in the growth of the computer industry.

In the field of consumer electronics, due to the saturation of the traditional consumer electronics market, the proportion of PCB applications has remained basically stable. PCBs are mainly used in home appliances, drones, VR equipment and other products in the field of consumer electronics.

In the field of automotive electronics, driven by intelligent driving and new energy technologies, it is expected to become a new driving force for the development of PCBs. PCB is mainly used in GPS navigation, car audio, car dashboard, car sensors and other equipment.

In the field of industrial control medical care, with the accelerated aging of the global population, the demand for portable medical and home medical equipment has grown rapidly, making medical equipment have broad development prospects. In the field of industrial control and medical treatment, PCBs are mainly used in industrial computers, frequency converters, measuring instruments, medical displays and other equipment.

North America is the largest market for PCBs in the aerospace sector, mainly due to the relatively developed aerospace manufacturing industry in the region. The Asia-Pacific region is the region with the fastest growth in aerospace PCB demand. Affected by factors such as the growth in demand for commercial aircraft driven by the continuous growth of passenger traffic, the market has recovered rapidly. In the aerospace field, PCBs are mainly used in aircraft, aerial remote sensing systems, aviation radars and other equipment.

3.5 Detailed classification of downstream applications

Communication field requirements: PCB requirements in the communication field can be divided into communication equipment and mobile terminals and other sub-fields. Among them, communication equipment mainly refers to the communication infrastructure used for wired or wireless network transmission, including communication base stations, routers, switches, and backbone networks. Transmission equipment, microwave transmission equipment, fiber-to-the-home equipment, etc.

Demand in the industrial control medical field: Industrial control equipment can be regarded as a kind of hardened and enhanced computer, which is used for industrial control to ensure reliable operation in the industrial environment. Industrial control equipment usually has high anti-magnetic, dust-proof, anti-shock and other performance, with special base plate, strong anti-interference power supply, continuous long-term working ability and other characteristics, such as highway, railway, subway and other traffic control systems.

Demand in the aerospace field: Aerospace PCB products are mainly used for aerospace airborne equipment, and airborne equipment can be divided into avionics systems and electromechanical systems, of which avionics systems mainly include flight control, flight management, cockpit display, navigation, Functional systems such as data and voice communication, monitoring and alarming; electromechanical systems mainly include power systems, air management systems, fuel systems, hydraulic systems and other functional systems.

Demand in the field of automotive electronics: Automotive electronics is a general term for vehicle body automotive electronics and automotive automotive electronic control devices. It is an electronic control system composed of sensors, microprocessors, actuators, and electronic components. With the increasing demand for overall safety, comfort and entertainment of automobiles, electronics, informatization, networking and intelligence have become the development direction of automobile technology; at the same time, new energy vehicles, safe driving assistance and driverless technology The rapid development has enabled more high-end electronic communication technologies to be applied in automobiles, and the proportion of automobile electronic systems in the cost of the whole vehicle has continued to increase.

Demand in the computer field: The amount of data in the 5G era has skyrocketed, and the demand for data centers is strong. In 2019, the global IDC scale was about 750 billion yuan, with a year-on-year growth rate of 21%. China’s IDC market size is 158.4 billion yuan, a year-on-year growth rate of 29%. China’s growth rate is much higher than that of the world. In mid-2020, the number of hyperscale data centers in the world has grown to 541, which has doubled from 2015. The booming demand for data centers has increased the demand for computer/server and data storage PCBs. Coupled with the rapid development of global cloud computing, the demand for cloud infrastructure such as servers and data centers continues to expand, and the corresponding PCB usage increases accordingly. Prismark predicts that the output value of PCBs used in servers and data storage will reach US$8.9 billion by 2025, with a compound annual growth rate of 8.5% from 2020 to 2025.

If you have any PCB demands, please feel free to contact us.

Email:[email protected]

Skype:[email protected]

Telephone number:+86 133 9241 2348

Whatsapp: +86 133 9241 2348